Back to Insights

Lloyd's 2025 Insights Report

The Lloyd’s Market Association (LMA) and Insurance Capital Markets Research (ICMR) are pleased to present their second annual report, providing analysis and insights following the Lloyd's 2024 results.

The full insights report, co-authored with ICMR, covers the overall performance of the market and conducts a detailed examination of individual syndicate performance. It explores the factors driving growth and profitability across syndicates of varying sizes and maturity levels. This year, the performance analysis has been expanded to include Reinsurance Property, Casualty and Specialty classes as well as a deeper analysis of expenses for delegated binder business.

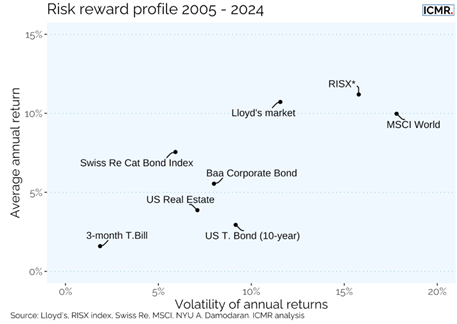

As before, the report benchmarks the market's performance favourably against liquid specialty (re)insurance investments and catastrophe bond indices. Lloyd’s continues to offer an attractive and relatively more stable return on capital over the long term with a low correlation with other asset classes, represented, for example, by the MSCI World Equity Index.

Figure 1: Risk reward profile of annual calendar year returns vs volatility (standard deviation). RISX equity index data from 2007 onwards only.

At an individual syndicate level, almost all syndicates have made an underwriting profit in 2024. Given the extra costs and capital loadings applied to start up syndicates, the analysis shows that 2022/23 was clearly a good time to commence underwriting in Lloyd's. The 2024 league table of syndicates by pre-tax results highlights the consistent performers over five years, however, pure premium volume is not the primary driver for inclusion in the top 10.

Table 1: Rank of the top 10 most profitable syndicates over the last five financial years, excluding legacy writers.

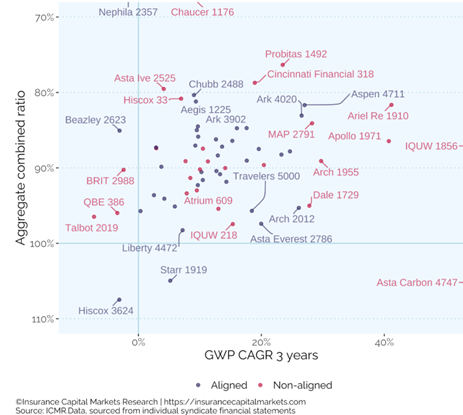

Over the last three years of a hard market for insurance rates, our analysis suggests that non-aligned syndicates may have been better able to grow than aligned syndicates, illustrating the importance of third-party capital to the vitality of the market.

Figure 2: Underwriting performance versus gross written premium growth for a three-year average, 2022-2024.

The full insights report is available on the ICMR website here.